Introduction

The healthcare industry is going through one of the most significant digital transformations in its history. From hospitals and clinics to diagnostic labs, pharmacies, insurance providers, and telemedicine startups, every healthcare organization today relies heavily on technology to deliver safe, efficient, and patient‑centric services. At the heart of this transformation lies one critical factor: choosing the right Custom Healthcare Software Development Company.

Healthcare is no longer just about treatment; it is about experience, accuracy, compliance, and scalability. Off‑the‑shelf software often fails to address the complex workflows, regulatory requirements, and data security needs of healthcare organizations. This is where a professional Custom Healthcare Software Development Company becomes essential. Custom‑built solutions are designed to align with real clinical processes, business goals, and long‑term digital strategies.

This in‑depth Technology and Business article explores how a Custom Healthcare Software Development Company supports modern healthcare organizations, why custom healthcare solutions are future‑proof, and how businesses can achieve long‑term ROI through tailored digital systems. The article is written in a natural, human style, fully optimized for search engines, and structured to remain relevant well into 2026 and beyond.

Understanding Custom Healthcare Software Development

Custom healthcare software development refers to the design, development, and deployment of software solutions that are specifically built for healthcare organizations based on their unique operational, clinical, and administrative needs. Unlike generic healthcare platforms, custom solutions adapt to the organization instead of forcing the organization to adapt to the software.

A reliable Custom Healthcare Software Development Company works closely with healthcare providers to understand their workflows, challenges, compliance requirements, and growth plans. The result is a system that improves efficiency, enhances patient care, and ensures regulatory compliance without unnecessary complexity.

Healthcare organizations often require software that integrates multiple departments, supports large volumes of sensitive patient data, and scales as services expand. Custom development ensures flexibility, interoperability, and long‑term sustainability.

Why Healthcare Organizations Are Moving Toward Custom Solutions

Complex Healthcare Workflows

Healthcare workflows are rarely linear. From patient registration and diagnosis to treatment, billing, and follow‑up care, every step involves multiple stakeholders and systems. A Custom Healthcare Software Development Company designs solutions that mirror these real‑world workflows, reducing errors and improving coordination.

Regulatory and Compliance Requirements

Healthcare software must comply with strict regulations such as HIPAA, HL7, GDPR, and regional healthcare laws. Custom solutions are built with compliance in mind from day one, ensuring data privacy, audit readiness, and secure information exchange.

Data Security and Privacy

Healthcare data is among the most sensitive types of information. Custom healthcare software allows organizations to implement advanced security protocols, access controls, and encryption standards tailored to their risk profile.

Scalability and Future Readiness

As healthcare organizations grow, their software must scale with them. A Custom Healthcare Software Development Company builds modular and flexible systems that support future expansion, new services, and emerging technologies.

Role of a Custom Healthcare Software Development Company

A professional Custom Healthcare Software Development Company does far more than just write code. It acts as a long‑term technology partner that supports healthcare organizations throughout their digital journey.

Key responsibilities include:

- Business and technical requirement analysis

- Healthcare workflow mapping

- UI/UX design for clinical and non‑clinical users

- Secure software architecture planning

- Integration with existing systems

- Regulatory compliance implementation

- Testing, deployment, and maintenance

By combining technical expertise with healthcare domain knowledge, a trusted development partner ensures that the final solution delivers measurable value.

Types of Solutions Developed by a Custom Healthcare Software Development Company

Electronic Health Records (EHR) and EMR Systems

Custom EHR and EMR systems allow healthcare providers to manage patient records efficiently while ensuring accuracy and compliance. These systems can be tailored to specific specialties, departments, or care models.

Hospital Management Systems

Hospital management software integrates multiple operational areas such as patient administration, staff scheduling, billing, inventory, and reporting. Custom development ensures seamless coordination across departments.

Telemedicine and Remote Care Platforms

Telehealth solutions enable virtual consultations, remote monitoring, and digital follow‑ups. A Custom Healthcare Software Development Company builds secure and user‑friendly platforms that enhance patient accessibility.

Healthcare Mobile Applications

Custom mobile apps support appointment scheduling, prescription management, patient engagement, and remote health tracking. These apps improve communication between providers and patients.

Medical Billing and Revenue Cycle Management

Custom billing software reduces claim errors, accelerates reimbursements, and improves financial transparency. Tailored solutions adapt to local insurance policies and billing workflows.

Healthcare Analytics and Reporting Tools

Data‑driven decision‑making is essential in modern healthcare. Custom analytics platforms help organizations track performance, predict trends, and improve outcomes.

Business Benefits of Custom Healthcare Software Development

Improved Operational Efficiency

Custom software eliminates redundant tasks and automates manual processes, allowing healthcare staff to focus more on patient care.

Enhanced Patient Experience

User‑centric design improves patient engagement, communication, and satisfaction. Personalized digital experiences lead to better outcomes.

Cost Optimization

While custom development requires an initial investment, it reduces long‑term costs associated with licensing, inefficiencies, and system limitations.

Competitive Advantage

Healthcare organizations using tailored digital solutions are better positioned to innovate, adapt, and compete in a rapidly evolving market.

Long‑Term ROI

A Custom Healthcare Software Development Company builds systems that grow with the organization, delivering sustained value over time.

Importance of Custom Healthcare Software Development Services

When healthcare organizations invest in custom Healthcare software development services, they gain access to expertise that bridges technology and healthcare operations. These services ensure that every feature aligns with clinical goals and business objectives.

Professional custom Healthcare software development services cover the entire software lifecycle, from concept and design to deployment and continuous improvement. This holistic approach ensures stability, compliance, and adaptability.

Healthcare providers that rely on experienced development services benefit from faster digital transformation, reduced risks, and higher system adoption rates.

Integration Capabilities and Interoperability

Healthcare systems rarely operate in isolation. Custom solutions must integrate with existing platforms such as laboratory systems, pharmacy software, insurance databases, and third‑party medical devices.

A skilled Custom Healthcare Software Development Company ensures interoperability through standardized protocols and secure APIs. This enables seamless data exchange and coordinated care delivery.

Emerging Technologies Shaping Healthcare Software in 2026

Artificial Intelligence and Machine Learning

AI‑powered healthcare software supports diagnostics, predictive analytics, and personalized treatment plans.

Internet of Medical Things (IoMT)

Connected medical devices generate real‑time patient data, improving monitoring and preventive care.

Cloud‑Based Healthcare Systems

Cloud infrastructure enhances scalability, accessibility, and cost efficiency while maintaining security.

Blockchain for Healthcare Data Security

Blockchain technology improves data integrity, transparency, and trust in healthcare information systems.

A future‑focused Custom Healthcare Software Development Company designs solutions that are ready to adopt these technologies as they mature.

Choosing the Right Custom Healthcare Software Development Company

Selecting the right partner is critical for project success. Healthcare organizations should evaluate potential development companies based on:

- Healthcare domain experience

- Compliance and security expertise

- Technical capabilities

- Communication and collaboration approach

- Long‑term support and scalability planning

A company like Digitrends, offering professional healthcare solutions through its dedicated Custom Healthcare Software Development Company expertise, understands both technical innovation and healthcare realities.

Future‑Proofing Healthcare Businesses Through Custom Software

Healthcare organizations that invest in custom solutions are better prepared for regulatory changes, technological advancements, and evolving patient expectations. A strong digital foundation enables continuous innovation without operational disruption.

By partnering with a trusted Custom Healthcare Software Development Company, healthcare businesses ensure that their technology strategy remains aligned with future demands.

Conclusion

The healthcare industry’s future depends on intelligent, secure, and scalable digital solutions. A professional Custom Healthcare Software Development Company plays a vital role in helping healthcare organizations deliver better care, improve efficiency, and achieve long‑term business success.

Through tailored systems, advanced security, and future‑ready architecture, custom healthcare software empowers organizations to meet today’s challenges and tomorrow’s opportunities. Investing in the right development partner is not just a technology decision; it is a strategic business move that defines the future of healthcare delivery.

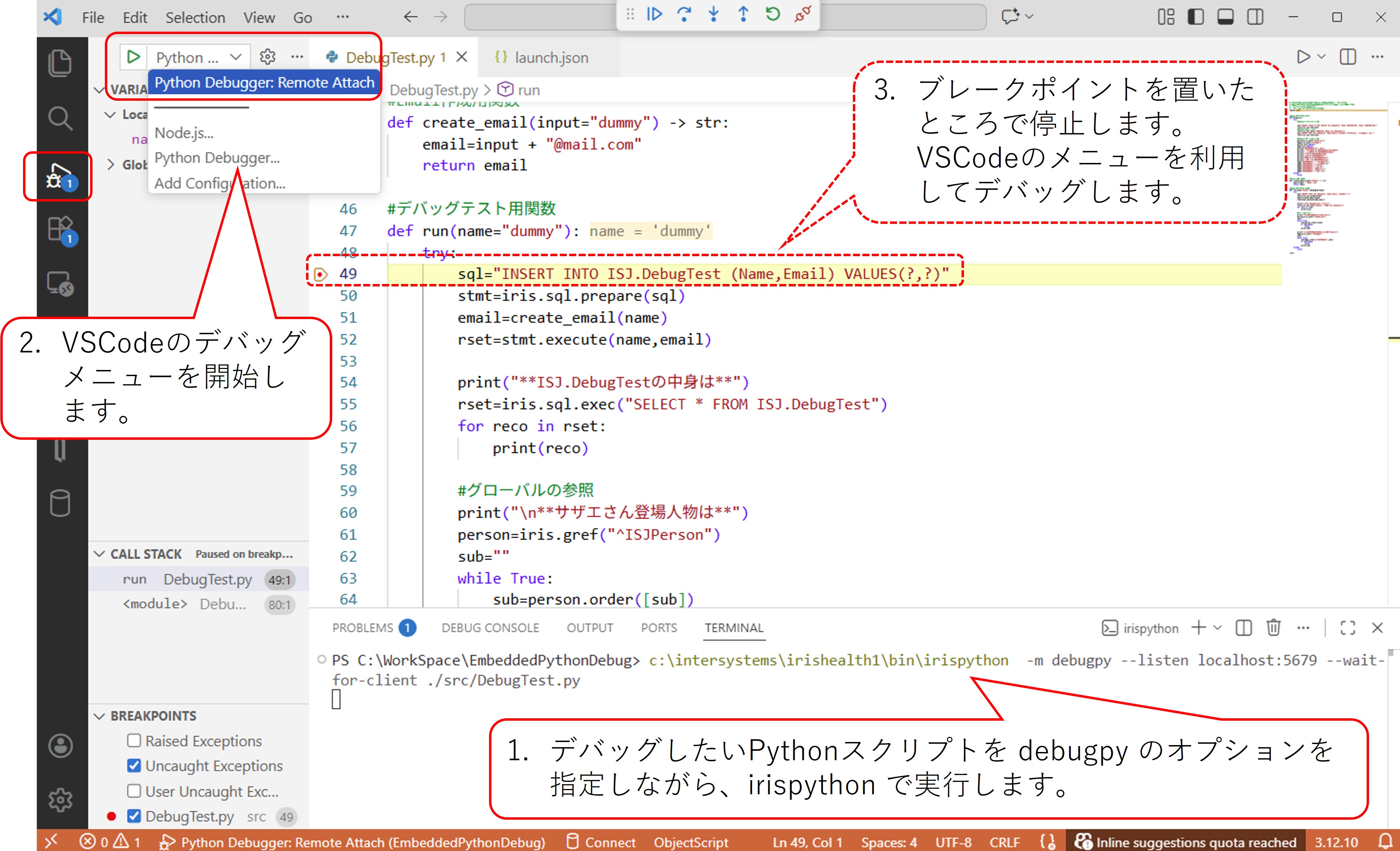

後は、VSCodeのメニューに従ってデバッグを進めます。

後は、VSCodeのメニューに従ってデバッグを進めます。